Standard

Reports and Listings

Oracle General Ledger delivers over 70 standard reports.

The following categories provide financial and non-financial information for

General Ledger data.

Standard Reports and Listings

Oracle General Ledger provides several types of reports and

listings to meet your business needs. All of the information in these reports

and listings is also available online.

You can obtain account analysis information, budget

information, chart of accounts listing, and many other types of data without

customization.

When

to Use Standard Reports

Use Standard Reports to do the following:

• To

view financial and non-financial information in trial balances, journals,

account analysis, and other reports

• To

group reports into report sets that can be run simultaneously

• To

schedule reports to run at regularly scheduled intervals

Financial

Statement Generator Features

Financial Statement Generator (FSG) is a powerful report

building tool for Oracle General Ledger.

Financial Statement Generator Features

Oracle General Ledger's Financial Statement Generator

empowers you to do the following:

•

Generate financial reports, such as income

statements and balance sheets, based upon data in your general ledger.

•

Apply security rules to control what financial

information can be printed by specific users and responsibilities in any

reports they run using FSG.

•

Define your reports with reusable report

objects, making it easy to create new reports from the components of reports

you've already defined.

•

Design custom financial reports to meet specific

business needs.

•

Print as many reports as you need,

simultaneously.

•

Print the same report for multiple companies,

cost centers, departments, or any other segment of your account structure, in

the same report request.

•

Schedule reports to run automatically.

•

Produce ad hoc reports whenever you need them.

Print reports to tab–delimited files for easy import into

client–based spreadsheet programs.

Use Financial Statement Generator Reports to do the

following:

• Create

custom financial statements

• Create

consolidated reports and perform consolidation for companies sharing the same

set of books

• Report

on translated and foreign currency amounts

• Report

on budget vs. actual and different amount types such as PTD, QTD, and YTD

Preparing

Your FSG Report

Plan your report before you begin building your rows and

columns.

Preparing Your FSG Report

Before you define a report in Oracle General Ledger, draft

your report on paper. Sketching the report in advance helps you plan the format

and content of the report and saves you time later.

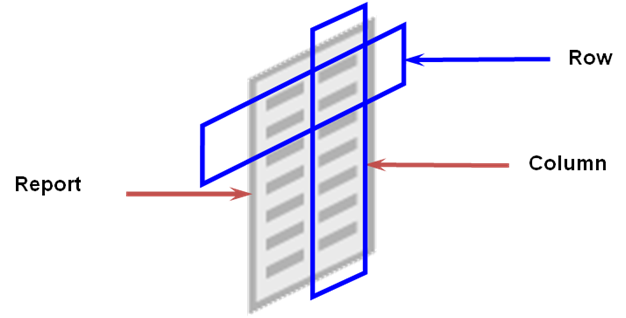

With FSG you use a fundamental row and column concept to

build your own financial reports:

• Decide

which rows and columns make up your report

• Define

the rows and columns

• Assign

attributes to the rows and columns

• Build

a report using the rows and columns

Building Basic Reports

Basic reports consist of a few headings to describe the

information in the report, followed by the report data, which is often

presented in tabular form as a series of intersecting rows and columns. Basic

reports are two dimensional, similar to what you might create in a spreadsheet.

Oracle General Ledger's Financial Statement Generator

(FSG) is a powerful and flexible report building tool you can use to build your

own custom financial reports without programming.

Financial Statement Generator

You can define custom financial reports, such as income

statements and balance sheets, online with complete control over the rows,

columns, and content of your report. You can control headings, descriptions,

format, and calculations in addition to the actual content. The reusable report

components make building reports quick and easy. You can copy a report

component from one report, make minor edits, then apply the report component to

a new report without having to create a new report from scratch.

Row Set

•

A required report component that defines the

rows of your report. Typically, accounts are assigned to row set definitions.

For each row, you control the format and content, including line descriptions,

indentations, spacing, page breaks, calculations, units of measure, and

precision.

Column Set

•

The second required report component that

defines the columns of your report. Typically, amount types are assigned to

column set definitions. You control the format and content of each column.

Report

•

You build a report by defining then combining up

to five reusable report components. At a minimum, you must have a row set and

column set for every report. Before you define a report using the Financial

Statement Generator (FSG), draft your report on paper. Sketching the report in

advance helps you plan the format and content of the report and saves you time

later.

Steps

for FSG Financial Reports

Use a four-step process to create and run customized

financial reports.

Steps for FSG Financial Reports

All reports require a row set and a column set. There are

three other optional report components that are used to apply special

formatting to your reports. For example, you can hide specific rows, rearrange

the sort order of your rows, display the account value and/or description, or

print reports by any accounting flexfield segment, such as department, on

separate pages.

Report Sets

•

A report set is a group of FSG reports.

Typically, report sets are used to group reports you run together frequently.

For example, you can create a month-end report set that includes a balance

sheet, an income statement by department, an income statement by company, and a

budget vs. actual income statement in a single submission without having to run

each report separately.

Defining

Row Sets

Define the format and content of rows in financial

reports.

Defining Row Sets

•

A single row set can be used for many different

reports. For example, Row Set A above is used for an Income Statement with

current information. It can also be used to produce an Income Statement for any

other entity (company, division, group, or cost center), or for the same entity

with a yearly comparison column.

•

A Row Set defines the format and content of the

rows in an FSG report. In FSG, the commonly assumed attribute for a row

definition is an account assignment, whereas the attribute for a column

definition is a time period or amount type. When you define a row set, you can:

Assign accounts:

•

To indicate which general ledger account

balances you want to include in the row. You can assign an individual account,

parent account, or range of accounts to each row.

Define calculations:

•

To perform a variety of complex computations in

your report. The calculations can refer to any previous rows in a report,

including rows you choose not to display.

Specify formatting:

•

To control page breaks, indentation, line

spacing, and underline characters. You can define a new row set, or use FSG's

AutoCopy feature to copy an existing row set, which you can then modify as

needed.

Note: If you have average balance processing enabled in your

set of books, you can report on functional, foreign, and translated average

balances.

Implementation Note

Row Set:

•

When creating a balance sheet, you must include

your entire income statement account range for the Current Period Retained

Earnings amount. Oracle General Ledger never posts the monthly net income

amount to an actual current period retained earnings account. This only happens

when the first period of a new fiscal year is opened. Thus, to achieve the

figure for current period retained earnings, it is a reporting solution where

you enter your Profit and Loss account range in the account assignment.

•

When creating reports, it is a good idea to

include check figures at the end of the report to verify that all accounts were

properly assigned in the reports. This is particularly useful if you have had

to enter account ranges with gaps because of the structure of your chart of

accounts.

•

For example, when creating a Balance Sheet, add

check figures at the end of the report defined as follows:

-

Total Assets 1000-1999

-

Total Liabilities 2000-2999

-

Total Stockholder's Equity 3000-9999. Note: In

order to derive the net income amount that is usually posted to current period retained

earnings, you must include your income statement account range.

Assigning Line Numbers to Rows:

•

You should enter line numbers in increments of

10 to allow for space to add additional rows for future modifications.

Account Assignment Display Option:

•

Oracle General Ledger stores debit balances as

positive numbers and credit balances as negative numbers. If you want your

credit balance accounts, such as liabilities, and revenues to display as

positive numbers, select the Change Sign check box. Doing so will have no

effect on your calculations.

Assigning

Accounts

You can select the sign and ranges of accounts for each

row in your row set.

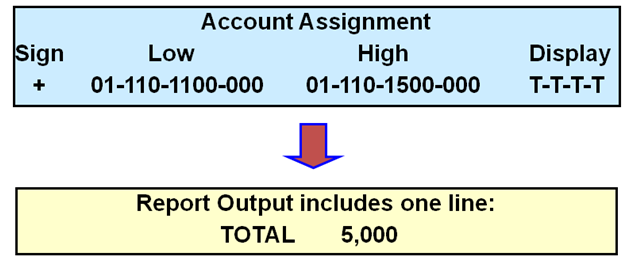

Assigning Accounts

Select the Account Assignments button to assign accounts for

a row set.

Select a numeric operator (+ or -) to add or subtract the

totals for the account range.

Enter a Low and High for the range of account combinations.

To specify an individual account, enter the same account as the Low and High.

You can leave these fields blank to create generic row sets with universal

account assignments.

Enter a Display type for each account segment:

•

Select "E" to expand the range and

display one report line for each segment value.

•

Select "T" to total the amounts in the

range and display only one total line for the segment values.

•

Select "T" for each segment of the

range if multiple account ranges are assigned to a row.

•

Select "B" to display both the

expanded detail and the Total. "B" combines the effects of

"E" and "T".

Implementation Note

Account Assignment:

•

You should always enter a unique Row Name for

every row. The Row Name does not appear in any reports, but it does appear in

lists of values when you perform calculations. If the row is simply a label,

for example, "Current Assets", that does not have any accounts

assigned to it, you should append the row name with the word "label"

to let you know that this row contains no accounts and you will not need to

include it in your calculations. Also be sure the row name is unique to ensure that

calculations yield the correct results. If you use the same row name for two

different rows, FSG will not know which row to use.

•

Consider creating generic row sets by applying

"T" display types for each account segment. You can later define

content sets to create more specific reports.

Defining

Calculations in Row Sets

To define formulas, Oracle General Ledger provides the

following mathematical operators:

Defining Calculation in Row Sets

Median - The midpoint or the middle value.

Average - The value obtained by dividing the sum total by

the number.

Standard Deviation - A value obtained by dividing by one

less than the number of squares in the sum of squares.

Absolute Value - Debit and credit values are both displayed

as positive numbers.

Note: Because Balance Control and Display Options are

usually defined for columns, they are covered in the Defining Column Sets

section. However, they may also be defined for rows.

Implementation Note

Row Set Calculations:

•

Oracle General Ledger stores credit balances as

negative numbers and debit balances as positive numbers. For example, revenue

accounts are stored as negative numbers and expense accounts are stored as

positive numbers. Therefore, you should define your calculations accordingly.

For example, to create a row called Gross Margin that calculates revenues minus

costs, you should add (not subtract) your costs row to your revenue row.

Reviewing

Your Row Set Definitions

Review row set component definitions using standard FSG

listings requested from the Submit Request window.

• Use

the FSG–Row Set Summary Listing to review the name and description of the row

sets defined and the report title and the chart of accounts associated with

each row set

• Use

the FSG–Row Set Detail Listing to review the row sequence, name, description,

amount type, period offset, currency, format and display options, account

assignment and calculations for each row of a row set

Reviewing Your Row Set Definitions

The main difference between these two reports is that the

FSG–Row Set Summary Listing summarizes all row sets while the FSG–Row Set

Detail Listing details only one row set.

Defining

Ad Hoc Reports

Create financial reports on the fly by defining ad hoc

reports in the Run Financial Reports window.

Defining Ad Hoc Reports

To run ad hoc reports, you select report objects and other

report parameters during the report submission process. With predefined report,

you can run the report with the parameters you saved in the report definition

or you can change the parameters at runtime.

Note: If you change the parameters at runtime, FSG will not

save them in the stored report definition.

Defining

Column Sets

Define the format and content of columns in financial

reports.

Defining Column Sets

•

Column sets define the format and content of

columns in your financial reports. Column sets include headings and

subheadings, currency assignments, amount types, exception conditions, and

calculation columns for totals.

•

You can define columns one by one as you do for

row sets, or you can build a column set graphically.

•

When you define a column set, you indicate which

Oracle General Ledger balance type you want to include in the column.

•

Although you normally assign accounts to your

rows, you can also assign an individual account combination or range of account

combinations to each column.

•

You can define calculations to perform a variety

of complex computations in your report.

•

The calculations can reference other columns in

the report.

•

You can define a new column set, copy

information from an existing column set, or use one of the standard column sets

provided by Oracle General Ledger.

Implementation Note

Column Sets:

•

When using the Quarter-To-Date (QTD) Amount Type

in column sets to perform quarterly reporting, you will need to create four

different column sets if you are using a non-standard calendar, such as a 13

period calendar because 13 does not divide evenly into 4 and the period offsets

will not give the desired results.

Column Set Amount Types:

•

When creating column sets that will be coupled

with Balance Sheet Row Sets, be sure to use the Year-to-Date (YTD) amount type.

Oracle General Ledger does not store YTD balances. Thus, in order to achieve a

cumulative total on balance sheet accounts, you must have FSG calculate the

amount for you using the YTD amount type.

Applying

Column Set Relative Headings

You can use relative headings to create dynamic column

headings which depend on the period you specify. Relative heading you can use

are:

• &POI

(Period of Interest)

• &BUDGET

• &DOI

• &ENCUMBRANCE

• &CURRENCY

Applying Column Set Relative Headings

&POI:

•

Enter &POI, followed by a number from -999

to +999 that refers to the relative period offset of your column.

•

For example, enter &POI0 to display amounts

for the period you specify at run time, enter &POI-1 to display amounts one

period before the period you specify at run time.

&BUDGET:

•

Enter &BUDGET, followed by a control value

number to print the budget name assigned to the control value number when you

define or run your report.

&DOI:

•

Date of interest, the date for which you want to

run the report.

&ENCUMBRANCE:

•

Enter &ENCUMBRANCE, followed by a control

value number to print the encumbrance type assigned to the control value number

when you define your report.

&CURRENCY:

•

Enter &CURRENCY, followed by a control value

number to print the currency assigned to the control value number when you

define or run your report column.

Standard

Column Sets

Oracle provides 14 standard column sets that cover a

variety of generic reporting requirements.

• Income

Statements

• Balance

Sheets

•

Other Reports

Standard Column Sets

•

Columns containing actual amounts for multiple

consecutive periods (trend reports)

•

Actual, budget, and variance columns (control

reports)

The generic column sets can be used for the following

reports:

Income Statements

•

Functional: Breaks out expenses by functional

area

•

Natural Account: Lists expenses by account or

groups of related accounts

Balance Sheets

•

Detail balance sheet accounts

•

Summary balance sheet accounts

Other Reports

•

Statement of changes to financial position

•

Daily activity reports

You can define these reports at whatever level of detail is

appropriate for your business.

Reviewing

Your Column Set Definitions

Review column set component definitions using standard

FSG listings requested from the Submit Request window.

• Use the FSG–Column Set Summary Listing to

review the name and description of the column sets defined in your current set

of books

• Use the FSG–Column Set Detail Listing to

review the column sequence, name, description, amount type, period offset,

currency, format and display options, account assignment and calculations for

each column of a column set

Row

Set and Column Overrides

A conflict exists if different values are entered for the

same option in both the row set and the column set.

Row Set and Column Overrides

Row Overrides Column

•

Amount Type

•

Period Offset

•

Control Value (Must assign same currency or

budget type at row and column level)

•

Format Mask

•

Factor

•

Display Zero

•

Level of Detail

Column Overrides Row

•

Override Row/Column Calculations (Conflict

exists only if the same value (Yes or No) is entered at both the row and the

column set levels)

•

Activity

Other Conflicts

•

Accounts: Report uses intersecting accounts.

•

Summary: Must assign the same summary option at

the row and column level.

•

Currency: Must assign the same currency at the

row and column level.

•

Change Sign: Yes overrides No.

Change Sign on Variance: Yes overrides No.

Defining

and Requesting Financial Reports

Mix and match row sets and column sets to create a

variety of reports.

Defining and Requesting Financial Reports

•

Once you define a report, you can save it and

use it whenever you run a financial report or define a report set.

•

You can copy a financial report you have already

defined and modify the new report as necessary.

•

You can also define ad hoc financial reports as

necessary to meet special reporting needs.

Caution: If the same Row Set is used in ten different

reports and you later modify the Row Set, the ten reports will be affected.

Implementation Note

Ad Hoc Reports:

•

All ad hoc reports are saved by FSG to be rerun

in the future. You can delete each report individually in the Define Financial

Report window or you can delete all of them at once by running the Program –

Delete Ad Hoc Reports from the Submit Requests window.

Running Reports:

•

If your FSG reports are not producing output or

you are having trouble getting a complicated report definition to work

correctly, you should view the log file for the Financial Statement Generator

in the Requests window. If the error message in the log file is not detailed

enough, change the user profile option FSG: Message Detail to full.

Handling

Rounding Problems

Oracle General Ledger offers two choices for handling

rounding problems.

Example: Format is 99999; Factor is Thousands

Specifying

Control Values

Specifying Control Values

You can report on budgets, encumbrance types, and other

currencies by using control values. Control values are numbers that you specify

in the Control Value field, of the Balance Control options region, on row sets

and column sets. When you define a financial report applying the row set or

column set containing a control value, you must specify what the control value

or number represents in the Define Financial Report window. There is a Control

Value button located on the Define Financial Report window which opens the

Control Values window. Here, you specify a number and a budget name,

encumbrance type, and/or currency. For currencies, you can specify

"entered" currencies or "translated" currencies.

Note: You must run translation before you use the

"translated" currency type.

For example, if you define a column set and specify a

control value of "1", you refer to the same number in the report

definition and assign either a budget name, encumbrance type, or currency to

associate with the control value.

Notes:

•

You must assign the same budget, encumbrance

type, or currency to intersecting row and column control values.

•

You cannot enter currencies in the report definition

if the report does not contain a row and/or column set with a currency control

value.

•

You must specify a budget or encumbrance when

your report includes rows or columns which use related amount types, such as

PTD-Budget or PTD-Encumbrance.

Defining

Content Sets

Define content sets to override segment values and

produce multiple versions of a single report.

Defining Content Sets

Even though content sets are optional, they are the most

powerful component of all FSG components.

By assigning a content set to a report request, you can

generate hundreds of similar reports in a single run. The content set controls

how the numerous reports differ from each other. For example, you can define a

departmental content set which prints a separate report for each department or

you can apply a content set to an expand row set to print a total report.

Content sets work by overriding the row set definition of an

existing report and replacing the row set account assignments and/or display

options.

Content sets can be saved as part of a report definition, or

can be added dynamically at the time you request an FSG report.

Hint: Consider using content sets exclusively to control the

specific output for each report.

Selecting

Display Options

Use display options to control if segment range values

are totaled and how they are displayed.

• RE

- Row/Expand

• RT

- Row/Total

• RB

- Row/Both

• CT

- Column/Total

• PE

– Page Expand Report

• PT

- Report/Total

• N

- No Override

Selecting Display Options

You can enter a display option for each account segment

range to designate how you want to display information in a report and whether

to print single or multiple reports.

RE - Row/Expand:

•

Select RE to expand the range and display a

separate line for each segment value in the range. If you are using parent

values, enter the same value as the high and low. Oracle General Ledger

displays only the children (or grandchildren). This is the same as selecting

Expand for row sets.

RT - Row/Total:

•

Select RT to total the amounts in the range and

display only one line as the Total line. This is the same as selecting Total

for row sets.

RB - Row/Both:

•

Select RB to expand and total the range. RB will

display a separate line for each segment value and display a total for all the

segment values. This is the same as selecting Both when defining row sets.

CT - Column/Total:

•

Select CT to total the range and display only

the total for the segment values. This has no effect on the report display.

PE – Page Expand Report:

•

Select PE to expand the range and create a

separate report for each segment value in the range. If you are using parent

values, enter the same value as the high and low. Oracle General Ledger

displays only the children (or grandchildren).

PT - Report/Total:

•

Select PT to total the segment value range and

display the total on one page.

•

N - No override: Select to use display options

entered in the row set definition.

Implementation Note

Display Options:

•

Page Expand (PE) Report is the most commonly

used display option. It allows you to perform consolidation within FSG.

Reviewing

Your Content Set Definitions

Review report component definitions using standard FSG

listings.

• Use

the FSG Content Set Summary Listing to review the names, descriptions, and

processing types of the content sets defined in your current set of books

• Use

the FSG Content Set Detail Listing to review the segment values and their

display types for a content set

Defining

Row Orders

Modify the order of detail rows in a report.

Defining Row Orders

You can use a row order with row expand row sets or content

sets to control how expanded detail rows are displayed in your report.

You can do the following:

•

Display account descriptions in addition to or

instead of segment values.

•

Sort detail rows by amounts displayed in a

column.

•

Sort detail rows by account segment values or

segment value descriptions.

•

Rearrange the sequence of your account segments

to fit specific reporting needs.

•

Suppress descriptions for particular account

segments.

Ranking

Methods

Determine in what order rows are displayed:

• By

segment value

• By

segment description

• By

values within a specified column

• Specify

what segment information to display:

• Value

• Description

• Both

Ranking Methods

Oracle General Ledger offers several ways to order and

display expanded detail rows. Select a ranking method and to display segment

values, segment value descriptions, or both. Alternatives include the

following:

•

Order by ranking, display description: For

example, department number.

•

Order by ranking, display both: For example, the

name of the department.

•

Order by description, display description: For

example, department description.

•

Order by description, display value

•

Order by value, display description

•

Order by value, display value

Reviewing

Your Row Order Detail Listing Report

You can use the Row Order Detail Listing to review the

ranking and display options of a row order.

Copying

Reports and Components

Create new reports and report objects by copying existing

objects using AutoCopy, then modifying the copied report objects. Items that

can be AutoCopied include:

Copyright Reports and Components

You can copy existing row sets, column sets, content sets,

row orders, display sets, reports, and report sets to create new report

objects.

After you copy a report object, you can modify the new

object instead of recreating a new object from scratch.

Caution: Modifying a report object will affect all reports

that use the report object. To avoid affecting all reports that use a report

object you want to modify, use AutoCopy to create a copy of the report object,

then apply the desired modifications to the copy of the report object.

FSG

Report Prerequisites

Prerequisite for running Financial Statement Generator

reports include the following:

• Use

the profile option FSG:Allow Portrait Print Style to control print orientation

• Define

security rules to limit the financial information a specific user can print

• Include

Program - Run Financial Statement Generator in your responsibility to run FSG

reports as standard report submissions

FSG Report Prerequisites

•

To control the print orientation of reports that

are less than or equal to 80 characters wide, set the user profile option

FSG:Allow Portrait Print Style.

•

To limit what financial information can be

printed by specific users on their FSG reports, define security rules and

enable them for use with FSG.

•

To run reports through standard request

submission, your System Administrator must assign Program - Run Financial

Statement Generator to the report security group for your responsibility.

Note: We recommend that you run the General Ledger Optimizer

program before you run your monthly reports. This will help your financial

reporting processes run faster. Program – Optimizer is run from the standard

report submission window.

Enabling

FSG Security

Use the General Ledger Super User or System Administrator

responsibility to define security rules to control what financial information

specific users can print when they run FSG reports.

Enabling FSG Security

If you have General Ledger Super User or System

Administrator responsibility, you can define security rules to control what

financial information specific users can print when they run FSG reports. For

example, you can prevent Company 01 users from printing reports for Company 02

and vice versa.

Run

FSG Reports from Standard Request Submission

Run FSG Reports from Standard Request Submission

You can request reports from the Run Financial Reports

window or through standard request submission (Submit Requests window). The

advantage of requesting reports through standard request submission is that you

can schedule the reports to run automatically. You can also combine FSG reports

with standard reports, listings, and programs. The disadvantage is that you

cannot run report sets through standard request submission.

Running

Financial Report Sets

• You

can include multiple reports in a single financial report set

• You

can include multiple financial report sets in a single multiple report set

• You

can run all or part of a report set

• You

can run several reports with predefined print options and parameter values

• You

can include a report more than once if you want to run the same report with

different parameter values

FSG

Tips and Techniques

To maximize your reporting flexibility and keep report

maintenance to a minimum:

• Draft

your reports on paper first

• Define

a logical chart of accounts and make use of Parent accounts

• Define

generic row sets and use existing column sets

• Use

the Expand and Both options

FSG

Tips and Techniques

To maximize your reporting flexibility and keep report

maintenance to a minimum:

• Select

the rounding option for your calculations

• Change

the order of detail rows

• Use

content sets and display sets for your report

• Use

AutoCopy

• Transfer

report objects from one database to another

Setting

FSG Options for General Ledger

Setting FSG Options for General Ledger

FSG: Accounting Flexfield:

•

Select the General Ledger application reporting

flexfield. The default value for this profile option is account. You cannot

view this profile option at the user level. Your System Administrator must set

this profile option at the site or application level.

FSG: Allow Portrait Print Style:

•

Control the print orientation of your Financial

Statement Generator reports that are less than or equal to 80 characters wide.

You can print these reports in either portrait style (80 character wide) or

landscape style (132 character wide).

FSG: Enable Search Optimization:

•

Enhance the performance of reports that contain

account assignments with a large number of parent segment values and child

segment value ranges. When you set this profile option to Yes, the FSG

performance enhancement is applied.

FSG: Enforce Segment Value Security:

•

Control whether your defined security rules will

apply to reports produced using FSG.

FSG: Expand Parent Value:

•

Control whether the rollup group or the summary

flag associated with flexfield assignments determine the expansion of parent

values when requesting summary balances.

FSG: Message Detail:

•

Specify the error message catalogue and level of

detail in your error message log file when you request your Financial Statement

Generator reports.

FSG: String Comparison Mode:

•

Do not change this profile option unless

instructed to do so by Oracle World Wide Support. This profile option affects

the character language for text-based character sets.